This is how you write the best business plan ever

How often do you get new business ideas? If you’re a serious entrepreneur or a business owner, you might have a new idea every day. But how do you know which ideas are worth pursuing?

The easiest way to objectively analyze any business idea is to write a detailed business plan. The question then becomes how to write a business plan. Yes, writing one might take time, but it will give you a definite answer if your idea is good or not. It will show you if your business idea is worth investing in.

Entrepreneurs and business owners are often afraid to write a business plan. They believe that it takes too much time and that the process is too difficult. In reality, what they are lacking is knowledge. Writing a business plan is simple if you know what you’re doing.

That’s why we put together this long guide to help you go through the process of writing your own business plan. We go into detail and break down each and every section you need to prepare to have a solid business plan.

Let’s jump straight into the process by first answering what exactly is a business plan.

What Is a Business Plan?

Most new businesses don’t know the importance of creating a plan for their company. Business plans are important because they help you clarify your goals and determine the steps you need to take to reach them (or how to achieve them). You can’t find success without first planning for it!

Most entrepreneurs put together a vision board, create a team, and start pitching their idea before they even know what they’re doing. But with a business plan, you can quickly understand your purpose, who you want to serve, and what resources are needed to succeed.

A business plan is a document that details the goals of a company. It can be as short as a few pages or as long as 100 pages or even more. The business plan includes detailed information on the company’s products, market analysis, financial data, and more.

Benefits of Having a Business Plan

You can think of a business plan as the blueprint of your company. It is essential to have a business plan because it shows your confidence in your product or service. It also helps you stay on track with your goals and keep focused. It’s a written document about the future of your business. It is used to help you decide what you want your company to be.

A business plan helps you decide what kind of future you want your company to have. You can use it to figure out how much money it will take, what kind of market to go after, and how many employees the company should have. A business plan can also help you figure out if there are any problems with your idea before starting the hard work of running a company.

The business plan is a document that guides a company. It should be updated periodically as the company grows. A changing environment will affect how the business operates, and therefore, it’s important to reflect these changes in the business plan. A shift in the market might make you pivot your company. You might want to diversify your offerings and add new products or services. Make sure you always include significant changes in your business plan. No matter where your business goes, your business plan should change with the company.

Business plans are essential for your internal audience, meaning your employees, and the internal audience, meaning banks and customers. Let’s give an example.

You need a business plan if you want to attract investors or get a bank loan. These are your external audiences. A business plan is also helpful when you want to make sure all team members are on the same page about strategic actions and the general direction of the company’s growth. Your team members are your internal audience.

We generally talk about business plans as something new businesses need, but that’s not the case. All companies should have a business plan and monitor it periodically, as we explained in one of the previous paragraphs.

Why Should We Have a Business Plan?

Writing a business plan sounds difficult. That’s why so many business owners and startups avoid doing it. But a well-written business plan comes with many different benefits. It’s one of the best things you can do for your business. We strongly believe that all serious businesses should have a business plan. We’ll even show how you can simplify the process by focusing on a few essential things. Here are four reasons why every business needs a business plan:

To Communicate The Plans with Stakeholders, Customers, and Partners

A business plan can be defined as a formal statement of your company’s goals and strategies to achieve them. This is especially important in the early stages of your company when you’re still defining what your business is and what it strives to achieve.

It is important to share your plans with stakeholders, including customers and partners, because it will help you communicate what you want to do. This will also increase their trust in you and give them an idea about your long-term goals. Your business plan serves as the single point of contact that provides all relevant information to all included parties.

To Measure Progress

To measure your goals with a business plan, make sure you have a clear understanding of the strategies you’ll use to achieve your goals. You can then evaluate whether or not this goal is being met by using metrics related to specific parts of the process. Some examples may include marketing ROI, number of new customers acquired per month, goal conversion rates for marketing campaigns, etcetera…

Your goals and strategies should be defined in your business plan. You can come back to it whenever you feel lost or don’t know what actions to take. You can also use it as a reference point for all new employees when you want to make sure they understand the company’s strategic goals.

To Demonstrate The Viability of The Business Model

A Business plan helps you keep track of the sources of revenue and expenses as well as potential risks. You can determine the viability of your business by comparing expected revenues and expenses. This detailed breakdown should give you confirmation that your business can operate profitably. If the calculations show otherwise, you should change your business model until you find something that has the potential to be a net positive.

This financial breakdown is one of the most important steps for your business. It shows wheater your business idea is something that can make money. This is one of the biggest benefits of your business plan.

To Secure Funding

A good business plan will give investors confidence in your startup and make them want to invest in you. It will also show potential investors that you are serious about your product and what it can be used for. Investors want to know that they can rely on the person they are funding, so having a well-made business plan is an important step in the process. They also want to know you have a solid plan for the future growth of the company.

A well-written business plan helps minimize financial risks for both the business owner and the potential investor. At the end of the day, the thing that matters most for investors is money. If the numbers don’t support the investment, they won’t help you start your business. That’s why you must crunch your numbers and present them in your business plan.

Your business plan acts as a bridge between you and your investors. It builds trust and sets solid foundations for your partnership.

As you see, having a business plan is a must. It can help you grow your business by setting the right strategies and measuring your success. It can also help you get funding to grow your business even faster.

Now that we know why we need a business plan let’s look at some tips that will help you write a business plan that will help you grow your business.

Simple Tips and Tricks to Write A Perfect Business Plan

Before we jump into the details and essential elements of writing a business plan, let’s first mention a few simple tips and tricks that will help you write the right business plan for your company. These tips are easy to copy. The focus is on execution. If you follow the tips we’ll lay for you, you’ll finish writing your plan faster. And you might even enjoy the process. So, here are some actionable tips and tricks to help you write your business plan.

Keep It Short and Simple

We mentioned that business plans could sometimes be longer than 100 pages. Should yours be as long as this? Of course not. No one is going to read it if it’s that long. The goal of your plan is to be shared and read. You want to make it as easy to digest as possible. Thats’ why you have to make your business plan short, concise, and easy to understand. Make sure you use simple words and avoid jargon phrases as words if possible.

Another advantage of having a short business plan is that a short plan is easier to change. We mentioned that your business plan shouldn’t be set in stone. It’s a live document that changes with your business. A long and complicated business plan ensures that no one is going to change it because the process is too tedious.

When it comes to business plans, short and simple is the way to go.

Be Logical and Avoid Empty Claims

It’s hard to be objective when developing your business. You’re personally involved and invested in the business. But, you have to do whatever it takes to analyze your business as objectively and logically as possible.

One of the easiest ways to do that is by using numbers and claims you can support with evidence. Just because you think something is true, it doesn’t make it so. Don’t include things that you believe are true in the business plan. Only focus on hard facts when making calculations and projections.

This will make your business plan a lot more credible. Potential investors want to see the numbers based on evidence. Their number one priority is profit. They aren’t interested in what you think about the market.

If you can’t separate yourself from your business, you might want to consider getting a mentor or hiring outside help to write your business plan.

Validate Your Business Idea

One of the reasons you’re even writing a business plan is to validate your business idea. You’ll do financial calculations and define your target market. When done correctly, your plan can uncover potential problems in your business idea. Hopefully, that won’t be the case, and the numbers that you calculate support your business.

It’s a lot easier to validate small chunks of your business. That’s why we suggest you start with a short and simple business plan draft before spending hours developing the details of your business. For example, start with creating your target market and buyer personas. Get real-world feedback from mentors, potential investors, and possible buyers to see if the personas you created represent your target audience.

Get feedback for every part of the plan that you make. Doing the plan in smaller steps makes it easier to change the plan and make strategic business shifts before you even launch your business. A step-by-step approach is the best way to write an action plan that is applicable in the real world.

Be Conservative with Your Projections and Goals

You probably heard that most business owners and entrepreneurs are life-long optimists. And that can certainly play in your favor as you grow your business. But it’s usually best to be conservative and cautious with your projections and goals when writing a business plan.

When you set the bar lower, you make it easier to reach your goals. Starting a business is hard enough, and having unrealistic goals is going to kill your growth. But when you use conservative estimations in your plan and still manage to make your business plan viable and profitable, then you can be assured you have an idea that can easily be turned into a profitable business.

Plan for the worst-case scenario, and if your business survives that hypothetical scenario, there’s no reason to believe you can’t make your business thrive. Make sure you don’t use projections that are too optimistic and set business goals you can fulfill.

Be Confident

We understand that the task of writing a business plan sounds daunting. A lot of entrepreneurs and business owners struggle with this. You might have doubts because you don’t have a formal business education. Or you might be afraid because you’ve never written a business plan before. Don’t let your doubts hold you back.

The truth is, no one knows your business as well as you do. That alone makes you the expert. The important thing is you start. Keep your momentum. The first line will be the hardest to write. But each passing page will get easier to write.

We already mentioned that starting with a simple plan is the way to go. That means you won’t have to spend days writing down a detailed plan at the beginning of your business journey. Focus on the essentials and worry about the details later. The important thing is you have faith in your skills. You know how to write the right business plan for your business.

Use Our Free Business Plan Template

We created a simple business plan template that will help you write your first business plan. The template includes all the essential parts you need if you want to write a solid business plan. We created the plan with modern businesses in mind. The template is suitable for both online and offline businesses.

How do you use the template?

Simple download the plan and fill in the blanks. The instructions on the plan are simple. Anyone that can read and write can follow them. This is the best and simplest way to write a business template that makes sense and accurately represents your business.

Here are some of the benefits of using our business plan template:

- You will write your business plan faster

- The template ensures you include all important information

- Your plan will be easy to read and understand

- The template is visually appealing

This is your time to shine. Download the business plan template and start writing the plan for your dream business today.

Traditional Business Plan vs. Lean Startup Plan

Business plans come in different forms and formats. Most of us have the traditional business plan in mind when talking about business plans. These are relatively long documents of around 40 pages that define the next three to five years of the business. They go into every possible detail that contributes to the success or failure of the business in question.

Lean startup business plans have been gaining popularity in the last few years. They are easier to create, which also makes them easier to change. They cover the basics of the business and don’t go into every detail. You can think of them as quick summaries of your business. These plans are suitable for simple and straightforward business ideas.

We must know the difference between both business plan types. We’ll go over the outlines of both. We’ll break down each element and explain what’s included in them. This will help you decide which plan is right for you. Let’s jump into the outlines of business plans.

Traditional Business Plan Outline

We mentioned that traditional business plans are very detailed. They are often used for corporations and big businesses. You’ll also have to write one if you plan on getting a bank loan. Most banks want a traditional plan. They want to make sure all aspects of your business are worth investing in.

Keep in mind that even traditional business plans come in different forms. There are no two plans that are the same. We’ll go over the most common elements that are usually included in business plans. That doesn’t mean you can’t add more or even skip some if you feel so.

Executive summary

The executive summary is the first thing in a traditional business plan. It includes basic information about the company, products, and services. It also includes information about the leadership team, employees, and location. It includes basic financial information and a few sentences about the growth plans.

Think about your executive summary as a high-level view of your business. Executive summaries are usually condensed into a single page. You can use a simple “problem-solution” format to write your executive summary.

Here’s the framework to help you write your summary:

For [target customers]

Who are dissatisfied with [current solutions]

Our [product or service] solves [key customer problems]

Unlike [competing product], we have [differentiating key features]

Simply fill in the blanks to get your summary statement. You’ll notice that what you just developed is basically your unique value proposition.

Other things you should address in your executive summary are your competitors and your target audience. Be precise when defining who your buyer personas are and what your ideal customer looks like. Make sure you’re aware of all your direct competitors and also take note of indirect competitors.

The last thing you should talk about in your executive summary is the need for funding. Will you apply for a bank loan? Are you searching for investors? Or are you bootstrapping the whole process on your own?

Opportunity

The opportunity part of your business plan is the most important chapter. It defines your target audience, what you have to offer, and how you differentiate from other players in your market. Use this section to plan your growth and set the right foundations for your business.

Target Audience

You should start the opportunity part of your business plan by defining your target audience and your ideal customer. The main question you need to ask yourself is who am I selling to? One of the traps businesses fall into is defining their target audience as everyone. That’s way too broad. You need to niche down your audience to give yourself a better chance of succeeding in the market. You can do market segmentation if there are many groups of people you can target.

We suggest you use the TAM, SOM, and SAM method when defining your market segments.

- TAM: Total Available or Addressable Market (everyone you wish to reach with your product)

- SAM: Segmented Addressable Market (the portion of TAM you will target)

- SOM: Share Of the Market (the subset of your SAM that you will realistically reach)

Following this approach, you’ll get solid numbers you can use for your financial calculations and projections. Don’t forget to look at the trends of each segment. Is the segment growing or shrinking?

Problems and Solutions

The next step you should focus on in the opportunity part of your business plan is defining all the problems your company solves. Think about what kind of problems your target customers face. What makes their lives miserable? How are they currently solving these problems? Are there more elegant solutions for the problems? Are they willing to spend money to solve their pains and problems?

These are some of the questions you need to ask yourself when thinking about your business’s solutions. Doing so ensures you’re developing products and services that solve real-world problems people are willing to spend money on. One way to get answers to these questions is to conduct customer interviews. Talk to your potential customers and ask them everything you want to know about their problems.

Buyer Persona

Now that we defined your target market and the solutions you provide, we can create your buyer persona or ideal customer. The buyer persona is a fictitious character that represents the average characteristics of your target market. We use buyer personas to personify your target market and their problems. You can imagine you’re talking to your buyer personas when creating marketing campaigns.

Competitors

Another thing you need to address in the opportunity part of the business plan are you competitors. No matter how niche your company is, there will always be competitors. Writing that you don’t have competitors is a huge mistake, and you should never do that in your business plan.

You can do a SWOT analysis of your direct competitors to compare how their offerings stack against your company. This should give you a solid understanding of how your company differs from your competitors. Use this knowledge to position your company in a way that captures the attention of your target market.

Execution

You’ve set the groundwork for your business. Now it’s time to plan how you’ll actually promote and market your company. The execution part of your business plan covers all your marketing endeavors and promotional strategies you’ll use. You also have to define the metrics you’ll use to measure the success of your marketing and sales efforts. You can be as detailed as you want in this section.

Marketing and Sales Plan

The most important part of your execution section is your marketing and sales plan. This is a detailed document that includes all information about how you’ll promote your business. This is what you give to your sales team and marketing department as a guideline.

Positioning statement

Your marketing and sales plan should start with your positioning statement. This is sometimes called your unique selling proposition or your value proposition. Brand strategists might argue that these things aren’t completely identical, but they are close enough for an average business. We already mentioned the “problem-solution” formula in the executive summary section:

For [target customers]

Who are dissatisfied with [current solutions]

Our [product or service] solves [key customer problems]

Unlike [competing product], we have [differentiating key features]

This is what defines your brand and helps you successfully market and promote your business. You need to know how you differentiate from your competition and what makes you unique. You have to understand what kind of unique value your business provides. We already answered most of these questions in the previous sections. Our job here is to combine all these elements into something we can use in the real world.

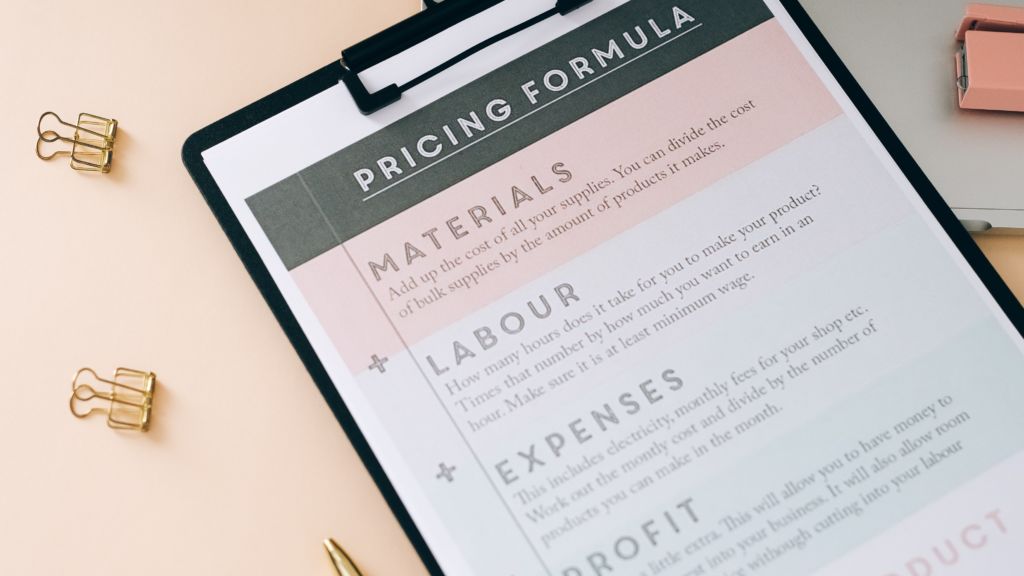

Pricing

Another thing you need to cover in the execution section is your pricing. You have to set specific guidelines for the prices of your products or services. There are two basic pricing models you need to know about:

- Cost-based pricing – this is where you calculate the costs you’ll have with your product or service, add a markup, and determine the price of your product or services.

- Value-based pricing – this is where you determine how much your customers are willing to pay for the solution your product or service provides.

Cost-based pricing is easier to calculate, and it’s what business owners often rely on when starting a business. Value-based pricing is great because it generally allows for higher profit margins, but it’s also harder to calculate. So, how do you determine which pricing model is better for your business?

You have to know your target audience and know what works best in your market. There are no rules to follow. You have to make a calculated guess based on the information you have.

Marketing Channels

Once you determine your pricing, it’s time to start thinking about your marketing. How will you promote your business? Which marketing channels will you use?

Again, it all comes back to your target audience. You have to understand where your buyers are. Do they use social media? If they do, you might want to promote your business there. You can use ads or try with organic growth and create interesting posts.

You have to know the difference between inbound and outbound marketing to pick the right way to promote your business.

- Outbound marketing – this is where you actively search for potential customers and reach out to them with your offering. Examples of outbound marketing include billboards, cold calling, direct mail, newspaper, and radio.

- Inbound marketing – this is where you create interesting content and information pieces that attract the attention of your target market. Examples of inbound marketing include blogs, video content, guidebooks, books, and more.

It’s up to you to pick which marketing strategy you’ll use for your company. It’s important you have a solid understanding of your market and your target audience.

Operations

This section defines how your business operates. This covers logistics and technology needed for your business. Keep in mind that not all businesses need this section. If your business doesn’t have a complicated supply chain or uses any technology, you can easily skip this section.

You have to describe how you’re sourcing products if you’re a reseller. Are you a manufacturer that has to source raw materials? This is where you describe the process. Investors are going to want to know about your supply chain and your suppliers. This is your chance to show them you have everything covered.

You also have to describe the technology you’ll be using. You don’t have to give away potential business secrets. It’s just important you paint a broad picture of your manufacturing process.

Distribution

Most service companies can skip this process. This section only really applies to distribution companies. So, what is distribution anyway? It’s how you get your products into the hands of your customers. There are different types of distribution you can pick for your business. The most common options are:

- Direct distribution – this is when you sell your products directly to customers. This is the simplest and most profitable method.

- Retail distribution – this is where you sell your products through different retailers, be it online or in physical locations.

- OEM – this stands for “original equipment manufacturer”. This is when you sell parts to another manufacturer that assembles them under their own brand.

We won’t go into detail about every distribution type. It’s up to you to pick the one that works best for your type of product.

Milestones and Metrics

Milestones are the major goals you need to accomplish. You don’t have to go into detail in this section. You want to use milestones to show potential investors that you have a well-defined path you want to take. It shows you know where you want to go and how to achieve your goals.

You also have to define a few key metrics you’ll monitor to determine the success of your business. The type of your business determines which metrics you’ll monitor. For example, a restaurant will have to keep track of different metrics than a consulting business.

Assumptions and Risks

This is an important section where you address everything you can’t reliably monitor. It might happen that you’re launching an innovative product, and there’s no chance to objectively validate your business. You will make an assumption that people are willing to spend money on the solution your product provides.

Knowing which assumption you made helps you monitor the risks of your business plan.

Company and Management Summary

This is the chapter where you present the organizational structure of your company. You will list key team members. This information is especially important to investors. They want to know who’s behind the company. It helps if key people of the organization have a proven track record of building successful businesses.

Team

You will present your key team members in this section. This is your chance to show you have the right people and team to make your business goals a reality. You can include short bios of essential team members. You can also list the advantages they bring to the team. It might also be smart to include potential shortcomings. This shows to investors you’re aware of the things you need to improve.

We also suggest you include an organization chart with members of your management team in this section of your business plan.

Company Overview

You can completely skip this section if you’re only creating your business plan to share with team members and employees. If you share your business plan with people outside your organization, include the following information in this section: mission statement, intellectual property information, a review of your company’s legal structure and ownership, your business location, a brief history of the company if it’s an existing company.

Financial Plan

This is the section that business owners are most afraid of. It can be daunting, especially if you don’t have a financial background. But the financial side of your business isn’t as complicated as you might think. It’s also very important you understand the basics if you want to build a successful business.

Most business plans have monthly sales and revenue forecasts for the first 12 months and yearly projects for the coming years. Financial projections are usually made for three to five years. Let’s go over what you should include in your financial plan.

Sales Forecast

This is a simple projection that shows how much you’ll sell in the coming months and years. It’s best if you use one row for each product or service you offer to make detailed projections and know what to expect for each product or service.

Make sure you also track the costs of goods sold. You have to know how much money you’re spending on each product or service before making a sale.

Personnel Plan

This section covers the costs of your personnel. How much will you have to spend on your employees?

You can break the plan into different positions in your company if that makes sense. Large organizations usually break their personnel plan into main organizational structures like “marketing”, “sales”, “accounting”, “administration”, and so on.

You also have to include all other costs related to your personnel. These typically include taxes, insurance, and other expenses that come with having people on the payroll.

Income statement

This is the section where all your numbers come together to show if your company is even profitable. Hopefully, you made a smart business plan, and the numbers show you’re building a profitable business.

The income statement includes the most important number in your financial plan – the bottom line. Your bottom line is the expenses subtracted from your earnings.

Most income statements include the following information: sales numbers, costs of goods sold, gross margin, operating expenses, total operating expenses, operating income, interest, taxes, depreciation, and amortization, total expenses, net profit.

Net profit is the number that shows if your business makes a profit or not.

Cash Flow Statement

Inexperienced business people often make the mistake of thinking that the cash flow statement is the same as the income statement. But that’s not the case.

Your cash flow statement takes into consideration the delay that comes with payments. For example, when you send an invoice, it might take up to 60 days for the recipient to pay the bill. But the invoice number will immediately show in the income statement. It will only show on the cash flow statement when the money gets on your account.

Managing your cash flow is an important skill that you need to master if you want to build a sustainable business.

Balance Sheet

The balance sheet provides an overview of your financial situation. It shows how financially healthy your business is. The balance sheet includes the assets in the company, the liabilities, and the owner’s equity. You can determine the net worth of the company if you subtract the company’s liabilities from assets.

Use of Funds

Only include this section if you’re raising money from investors. This is where you explain how you’ll use their money. You don’t have to go into detail and include every dollar. A brief overview will suffice.

Exit Strategy

This is the last section of your financial plan. It’s important to plan your exit strategy if you ever plan on selling your business. If you have investors, they will definitely want to know what your plans are. They want to get a return on their investment, and this is of vital importance to them. This is another section where you don’t have to go into too much detail.

Appendix

This isn’t a required section of a business plan. You should include different charts, legal documents, and briefs that are important but didn’t get included in any of the previous sections. This is the place where you should include any patents or trademarks if you have them.

Lean Startup Plan Outline

A lean business plan is the opposite of traditional business plans. Lean plans are short and include only the basics of the business. You can think of them as first drafts of traditional business plans. So, why would you consider creating a lean business plan instead of a traditional plan?

For starters, lean business plans are easier to write. It takes less time to get one developed and created. They are also easier to change and revise. In fact, they are made to be changed. The whole premise behind lean business models is to regularly change them to fit the current state of the market and the business. These plans are especially suited for young companies that don’t have precisely defined operations.

Lean business plans are meant for people inside your organization. They help every member of the team understand the direction the company is going towards. If you want to share your plan with people outside your organization, you’ll have to invest the time and resources to write a traditional business plan.

Lean business plans also won’t help you get financing. Banks and most investors want to see a complete business plan before they decide they want to fund your business.

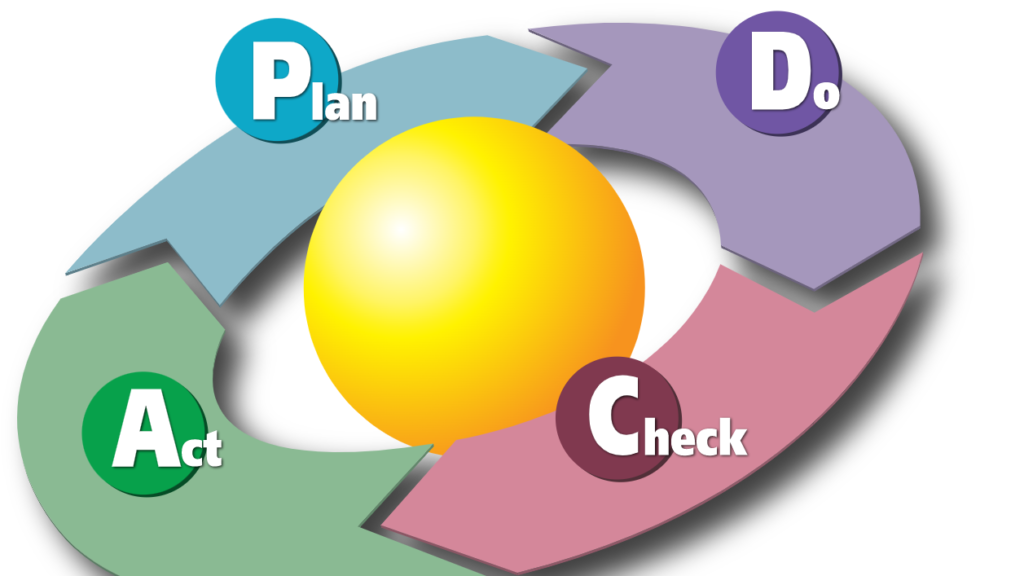

PDCA – Plan-Do-Check-Adjust

The lean business plan method is based on the PDCA framework. The model is built around cycles where you plan, do (execute), check (analyze), and adjust. This means that a lean business model demands constant revisions and modifications.

You start by planning your broad strategy, which you then test in real-world situations. You gather feedback from the implementation and check the results. Based on this, you then adjust the strategy you planned in the first step and repeat the cycle. As you see, this model helps you make small but meaningful changes that improve the way your business operates.

Because of the constantly changing business environment, it makes sense to use a simple business plan that can easily and quickly be revised.

Let’s now look at what you need to include in your lean business plan. It’s important we understand there’s no uniform outline for lean business plans. You can create something completely unique and include the information that’s important for your business. The elements we’ll list are common across different lean business plans, regardless of the business itself.

Strategy

Your strategy defines how you do business, how you talk about your solutions, what kind of problems you solve, and who you’re selling to. You need to understand your customers and have a solid understanding of the benefits your products or services provide.

You don’t have to go into detail about any of these. This isn’t a traditional business plan. We suggest you keep all the information in bullet points. This makes the plan easy to skim and read. You want your team members to regularly go back to the plan to remember the most important aspects of your business operations.

Execution

This section covers how you plan on executing your strategy. What good is your strategy if you don’t make sure you implement it? Use this section to define which marketing channels you’ll use and what kind of messages you’ll spread.

You can segment your buyers into different groups if that’s what your business needs. But your execution is more than just marketing. You should also mention your personnel and funding in this section. Explain how you plan on hiring new workers and where you’ll get your initial funding. Again, you don’t have to go into detail. This plan is meant for your team members and management.

Specifics

This is where you keep track of all the things you need to monitor. Note all the assumptions you had to make to write your strategy and execution. List down all the risks that come with your business plan.

This is also the place where you define your most important performance metrics. You have to have concrete things to measure if you want to objectively show how well your business is doing. You can also include expectations and major goals and track how well you’re meeting them.

Essential Business Numbers

We’ve gone into detail about financial planning in the traditional business plan outline. While you don’t have to be as specific for a lean business plan, you still have to include concrete business numbers in the plan.

Instead of going into detail, you should focus on the most important financial numbers that really matter for your business. These include your sales forecast, spending budget, and cash flow projection. If you take care of these, you’ll have more than enough to build your business.

Is Lean Startup Plan Right for You?

A lean startup plan might look like a simple solution to a common business problem that is writing long and complicated business plans. We suggest you always start with a lean plan, regardless if you plan on developing it into a complete plan later on. You can either stop once you have your lean plan or use it as a draft for your traditional business plan.

Most startups would benefit from a lean plan, especially if you work with innovative technology that’s constantly changing. Or if you’re operating in a new niche that is developing at a rapid speed. In these cases, you want a business plan that you can change as quickly as possible. And a lean plan is perfect for that.

Remember, a lean business plan on its own is useless if you don’t use cycles to constantly monitor and revise the plan. Plan your strategy, execute, monitor, and make adjustments. Hopefully, each cycle brings you one step closer to your business goals.

Also, keep in mind that a lean business plan isn’t always enough. There are certain situations where you’ll absolutely have to write a complete traditional business plan. Luckily for you, you can use this article to speed up the whole process.

Common Mistakes When Writing a Business Plan

We’ve covered the basic elements and outlines of modern business plans. We believe this is more than enough to get you started working on your plan. But, there are some additional things we want to add to help you write the perfect business plan for your company.

This section covers some of the most common mistakes businesses make when writing their business plans. Make sure you avoid doing them yourself. This alone should be enough to make your plan stand out.

Poor Writing and Bad Grammar

You’re not an English major, and we understand that. No one is expecting to read a Hemmingway novel when they pick up a business plan. But that doesn’t mean you can be sloppy.

The least you do is make sure there are no obvious grammatical mistakes in your plan. You can use online grammar checkers like Grammarly or hire outside help to make sure everything is spelled correctly. Online grammar checkers aren’t perfect, but they will find the most obvious mistakes.

At the end of the day, your business plan represents your business. And the last thing you want people to think is that you’re sloppy or unorganized, which is what a business plan filled with mistakes shows.

Incomplete Information

We went over the outlines of both the traditional business plan and the lean startup plan. Both plans should include all vital information about your business and your operations. No matter how short your plan is, you have to make sure you include everything a potential investor would want to know.

Your target market, buyer personas, strategy, competitive advantage, and basic financial statements are the minimum you must include in your plan. People might think you’re hiding something if you don’t include it in your plan.

Vague Assumptions and Projections

We already mentioned that everything in your business plan should be based on concrete numbers and data you can back. Making wrong assumptions is one of the most common mistakes we see people make.

Your business plan should be as objective as possible. Avoid using numbers you can’t back with real-world data. Don’t make assumptions that don’t have proof. Investors and partners will see right through if you use numbers and projections that don’t make sense. Remember, these are the people that read business plans daily.

Too Detailed

While you should avoid vague assumptions and projections, you also have to make sure you don’t go into too much detail, especially in the description of the technology you’ll use for your business.

Sharing information is good, but there’s a good chance you’ll have to change your plan often and regularly. The more detailed information you include in your plan, the more you’ll have to change later on. Plus, investors are rarely interested in technical details. They simply want to know if their investment is worth it.

No Risks

Every investor and every lender understands that there are no such things as risk-free businesses. There are risks if you’re starting a business. Make sure you include them in your business plan.

Some business owners are afraid that potential risk might make investors back down. But the opposite is true. By noting your risk, you’re showing to your investors that you understand where your business might fail. And by knowing this, you can prevent a lot of potential problems.

No Competition

We’re always surprised when we see how many businesses claim they have no competition. That’s simply not true. Every business has competition, and understanding who you’re competing with helps you better position your business.

There are two types of competition – direct and indirect. While you might not have many direct competitors if you’re operating in a completely new market or niche, you certainly have indirect competition.

Your investors want to see you understand your market well enough. Show them this by noting all the companies that compete with you for the same customers.

As you see, there are different mistakes businesses make when creating their business plan. We only covered the most obvious ones. Keep them in mind and make sure you avoid them in your business plan.

Coming Back to Your Business Plan and Making Changes

We learned that your business plan should be a living document that you often come back to and revise. We also established that some businesses have to constantly change and adjust their plans. For them, going with a lean startup plan makes a lot more sense since a lean plan is easier to change and adjust.

But, regardless of the business type and mode, all businesses should come back to the plan o a regular basis.

How often should you update your business plan?

This depends on your business. You should at least update your plan every time there’s a major shift in your market. When a new technology emerges that changes the landscape. Or when a new player enters your market.

Most large organizations should update their business plans at least once a year. This is a solid timeframe to reevaluate positioning, value proposition and analyze the current market space. It’s also recommended to do a quick tune-up every month. This allows businesses to quickly check if anything changed in regard to their business plan.

The smaller the organization, the more common the changes in their business plans. That’s why a lot of startups use the lean startup plan. They change their plan after every cycle they make. How long are the cycles? That depends. They have to be long enough to provide enough feedback to make adjustments. But modern startups often make changes to their plans on a monthly basis.

What are the benefits of keeping your plan updated?

Because this helps companies stay current with the times and evolve their operations. It’s important businesses constantly monitor what’s happening around them. And going through business plans enables them to analyze their market in a structured manner.

It also helps you keep all partners, investors, and management on the same page. By keeping your plan updated, you make sure that the latest version always reflects what key company members think. It ensures that everyone shares the same values and understands where the company is going.

By updating your plan, you also ensure you’re always keeping track of laws and regulations in your field. The last thing you want is for your business to get into legal trouble because you weren’t aware you were not in accordance with the law.

Should You Use Business Plan Templates and Software?

In previous chapters, we learned how to write a business plan, everything you need to include, and we shared some actionable tips that will help you write the perfect business plan for your business. We know that writing a business plan isn’t easy. There are ways to make the process easier for you, at least in theory. You can use templates or specialized software. But should you?

Let’s look at the advantages and disadvantages of using business plan templates and software. First, lest focus on the advantages.

The most obvious advantage of templates and software is that they give you structure. They navigate you step-by-step through the whole process. They ensure you don’t forget anything important, and they keep you accountable by showing you everything you need to write.

The templates and software also guide you through the process. They help you start with the most important parts and slowly build to the finer detail. This can be handy for technical sections like financial projections, especially if you don’t have a financial background.

But, there are also some disadvantages to using templates and software. First, some templates are too rigid. We have already established that every business is unique, and no two business plans are the same. A template might include sections that aren’t necessary for your business, and you could spend valuable time developing things that you don’t need.

Another disadvantage of temples is that they often kill your creativity. Your business plan is the extension of your business, and you have to make sure it matches the personality of your business. A template or software can be too technical and won’t allow for personalization.

The basic tools you’ll need to write your business plan are a word processor and something that can handle simple mathematical operations. You can use paid tools like MS Word and Excel, or you go with free tools like Google Docs and Sheets.

As you see, there are pros and cons to templates and software. They can help you speed up the process, but they can also be too rigid. It’s up to you to decide if you’ll use them or not. Think about what makes the most sense for your business.

Videos and Additional Tips

We shared a lot of valuable information in this article. We understand that this can easily get overwhelming, especially if this is the first time you’re writing a business plan. It’s easier to remember new information if you hear it more than once. That’s why we selected a few YouTube videos that talk about business plans.

You can watch this in your bed, on the couch, or when traveling on the subway. Just plug your earphone, and you’re ready to go. The information in the videos is similar to what we shared with you in the article. We suggest you come back to this guide if you feel lost or need to make sure you understand what goes into developing a business plan.

Here are some of the videos we recommend you watch if you want to learn more about writing business plans for modern businesses:

How to Write a Business Plan – Entrepreneurship 101 by Gillian Perkins

How To Write a Business Plan | Start a Business in 10 Steps by Learn by Shopify

Tide Masterclass: How to write the perfect business plan by Tide Business

It’s important to be critical of the information you receive from free content. That’s especially true on large platforms like YouTube. Anyone can make a video and call themselves an expert. Make sure you only consume content from trusted sources. The best way to make sure the content is valuable is to compare it with our article.

We spend hours gathering the information before presenting it to you in this easy-to-digest form. Everything you need to know to write a solid business plan is included in this step-by-step guide.

Conclusion

Writing a business plan isn’t easy. But it’s also not as hard as most people think. You have to know what you’re doing, and it all starts with setting the right structure. We shared everything we know about writing a business plan with you. Our detailed guide should provide you with everything you need to create a business plan that represents your business.

We hope you’ll use this article as a reference point every time you need help with your business plan. We’ll make sure we keep the article updated, just like you have to make sure you keep your business plan updated.

Be confident and start working on your business plan today. And be sure to share this article with anyone that might benefit from knowing more about writing modern business plans.

Leave a Reply